The Portugal Golden Visa program allows foreigners to obtain residency in Portugal through qualifying investments, with the investment funds option emerging as one of the most popular choices.

Currently, with increasing demand from U.S. citizens accustomed to dealing with financial applications, Portuguese Golden Visa funds now account for more than 30% of all permits issued. Unlike the traditional real estate investment route, investing in these funds entails lower fees and taxes. Moreover, depending on the fund’s structure and the investor’s tax situation, this option can offer significant tax advantages.

Portugal Golden Visa Overview

The Portugal Golden Visa program, launched in 2012, is a five-year residency-by-investment initiative for non-EU nationals. It grants qualifying investors and their families the right to live, work, and study in Portugal. By transferring capital into a qualifying Golden Visa fund, applicants can secure residency.

After five years, Golden Visa holders may apply for permanent residency or Portuguese citizenship, provided they meet the requirements. Citizenship offers EU benefits, such as the ability to live and work across member states, and a Portuguese passport granting visa-free access to 188 countries.

Since its inception, the program has raised over €7 billion from non-EU citizens looking for obtaining Portuguese residency. While the investment fund route is popular, other options include:

- Cultural Donation: €250,000 to arts or cultural heritage restoration.

- Scientific Research: €500,000 investment in science or technology.

- Job Creation: Create and maintain ten jobs.

- Company Set-up: €500,000 investment in a business, paired with creating five or maintaining ten jobs.

Investment thresholds for some options may be reduced by 20% in low-density areas.

What is the Portugal Golden Visa Investment Fund?

Golden Visa Investment Funds have become a popular pathway for investors seeking residency in Portugal. The program requires a minimum investment of €500,000 in a qualifying venture capital fund, enabling non-European Union citizens to secure a Portuguese residence permit.

These funds typically target sectors such as technology and startups and must be registered with the Comissão do Mercado de Valores Mobiliários (CMVM), Portugal’s financial regulatory body. Their primary purpose is to channel capital into the growth and capitalization of Portuguese companies.

To qualify, the funds must comply with strict regulations, including maintaining the investment for at least five years and ensuring that a minimum of 60% of the fund’s capital is invested in companies headquartered in Portugal.

Who Can Invest for the Golden Visa Investment Funds?

The following applicants are eligible to qualify for the Golden Visa fund option in Portugal, provided they meet the criteria outlined below:

1. Non-EU/EEA or Non-Swiss Citizenship

Applicants must not hold citizenship in the European Union (EU), European Economic Area (EEA), or Switzerland. The program is designed exclusively for individuals from outside these regions.

2. Clean Criminal Record

Applicants must have no criminal convictions, ensuring they pose no security or legal risks to Portugal. A clean record is required both in the applicant’s home country and any other country where they have resided for more than one year.

3. Age Requirement

Applicants must be at least 18 years old at the time of application to be eligible for the program.

4. Sufficient Legal Funds

Applicants must demonstrate that they possess the financial means to make the minimum investment of €500,000 in a qualifying investment fund. These funds must be legally obtained and traceable to ensure compliance with anti-money laundering regulations.

Can US Citizens invest in Portuguese Investment Funds for a Golden Visa?

Yes, American citizens are eligible to pursue the investment fund pathway under Portugal’s Golden Visa program. However, due to U.S. tax regulations, the IRS requires foreign financial institutions to report on the foreign assets held by U.S. account holders. As a result, any bank or fund in Portugal working with American clients must comply with U.S. government reporting requirements.

In Portugal, not all banks are willing to work with American investors due to these additional compliance obligations. However, there are a few banks that accommodate American investments and provide the necessary reporting to U.S. tax authorities, ensuring a smooth process for Golden Visa applicants.

Advantages of the Portuguese Golden Visa Investment Fund

There are several advantages of choosing the Portugal Golden Visa investment funds compared to other investment routes.

Disadvantages of the Portuguese Golden Visa Investment Fund

The Portugal Golden Visa also has some advantages that investors should take into consideration.

List of Funds Qualifying for the Portuguese Golden Visa

For the Golden Visa program in Portugal, there are various types of investment funds that applicants can explore. These funds are specifically structured to meet the program’s requirements, offering residency opportunities to non-European Union (EU) citizens who make qualifying investments. Below are some common types of investment funds that qualify for the Golden Visa program in Portugal:

1. Venture Capital Funds

These funds focus on investing in innovative businesses and startups within Portugal. By providing capital to high-growth-potential companies, they contribute significantly to the development of the Portuguese economy.

2. Private Equity Funds

Private equity funds invest in established companies with strong growth potential. These funds often acquire a significant ownership stake in the target companies and actively participate in their management and strategic direction, aiming for a profitable sale in the future.

3. Hospitality Investment Funds

These funds focus on Portugal’s booming tourism and hospitality sectors. Investments typically include hotels, resorts, and other tourism-related properties, offering both financial returns and a boost to the local economy.

4. Sustainable Investment Funds

Sustainable investment funds channel capital into projects that deliver measurable social and environmental benefits. These ESG-focused funds often invest in renewable energy, sustainable development, affordable housing, and community enhancement initiatives.

5. Football Investment Funds

These unique funds capitalize on Portugal’s passion for football, investing in clubs, player development programs, and related ventures, contributing to the growth of this globally popular sport.

6. Agriculture Investment Funds

Agriculture-focused funds invest in Portugal’s agricultural sector, supporting projects related to farming, food production, and agri-tech innovations that strengthen the country’s agricultural economy.

Key Considerations Before Investing in Portuguese Golden Visa Funds

Questions to Ask Yourself When Choosing the Fund

- What is my risk tolerance, and does this fund align with it?

- What is my investment timeline, and can I meet the minimum holding period of 5 years?

- Does the fund’s sector (e.g., real estate, private equity, venture capital) match my investment interests?

- Are the expected returns in line with my financial goals?

- Am I comfortable with the level of liquidity provided by the fund?

Questions to Ask Your Legal or Consultancy Firm

- Is this fund compliant with the Golden Visa program requirements?

- Have you reviewed the fund’s prospectus and legal framework for any potential risks?

- Are there any tax implications I should consider with this investment?

- Are there additional costs, such as legal fees, that I need to account for?

- How experienced is the firm in handling similar Golden Visa investments?

Questions to Ask the Fund Managers

- What is the fund’s investment strategy and target sectors?

- What is the expected rate of return, and how is it calculated?

- What is the fund’s maturity date, and what happens at the end of the term?

- Are there any buyback options or exit strategies for investors?

- What are the management fees and other costs associated with the fund?

- Can you provide details about the fund’s track record and portfolio performance?

- Are there any restrictions or limitations on transferring participation units?

Who Regulates Portuguese Investment Funds

Portuguese Golden Visa investment funds are regulate by several entities and frameworks to ensure transparency, compliance, and investor protection. Here is an overview of the regulatory aspects:

Portuguese Securities Market Commission (CMVM)

The CMVM oversees and regulates investment funds in Portugal, including those eligible for the Golden Visa program. They establish rules and requirements for fund registration, operation, disclosure, and investor information.

Golden Visa Program Regulations

The Golden Visa program itself has specific regulations that govern the investment funds qualifying for the program. These regulations set forth the criteria, minimum investment amounts, investment periods, and other requirements for funds to be eligible for the Golden Visa.

Fund Management Companies

The fund management companies responsible for operating the investment funds are subject to regulatory oversight by the CMVM. They must adhere to specific rules regarding fund management, risk management, reporting, and compliance with relevant laws and regulations.

European Union (EU) Directives

As a member of the EU, Portugal must comply with EU directives and regulations related to investment funds. These directives provide a framework for investor protection, disclosure, and harmonization of fund regulations across EU member states.

Exiting a Portuguese Investment Fund: Key Considerations

You can exit a Portuguese investment fund, but there are certain conditions and considerations to keep in mind:

Minimum Holding Period

To qualify for the Portugal Golden Visa, you must hold your investment in the fund for a minimum of 5 years. This is tied to the visa’s requirement, and you cannot sell or transfer your participation units before this period ends without jeopardizing your residency status.

Transfer of Participation Units

Participation units in most Portuguese investment funds can be transferred or sold between investors. However, it is often challenging to find demand for these units, particularly in funds designed to align with Golden Visa timelines, unless the trade occurs near the fund’s incorporation. As a result, Portuguese investment funds tend to be relatively illiquid until they either reach maturity or are dissolved by the fund manager.

Buy-Back Option

Some Portuguese investment funds, though uncommon, have longer terms and offer the option to buy back an investor’s participation units after they have completed the required holding period for the Golden Visa. However, these funds typically provide lower returns compared to others.

Extension Period

Some funds are structured with an extension period that allows fund managers to prolong the investment cycle (usually 1–3 years beyond the original term). If an extension clause exists, you may need to remain invested for longer, depending on the fund’s discretion.

Costs and Fees for Portugal Golden Visa Investment Funds

The fees associates with Portugal’s Golden Visa investment funds can vary depending on the specific fund you choose and its management structure. Here are some common types of fees that you may encounter when investing in Golden Visa investment funds in Portugal:

1. Government Fees

When applying for the Golden Visa, you should consider the following fees:

- Processing Fee: €605.10 per applicant

- Initial Application Fee: €6,045.20 per applicant

- Renewal Application Fee: €3,023.30 per applicant at each five-year renewal.

2. Fund Management Fees

These fees are charge by the fund manager for overseeing the fund’s investments and making strategic decisions. Management fees are typically calculates as a percentage of the total assets under management (AUM) and are typically charged annually. They can range from 1% to 2%

3. Performance Fees

In some cases, investment funds may charge performance fees if the fund achieves certain predefined performance benchmarks. These fees are typically calculate as a percentage of the fund’s returns above a specify hurdle rate. Typically these fees range between 20-30%

4. Subscription Fees

Some funds may charge fees when you initially invest in the fund. These fees are often a one-time expense and may use to cover administrative costs associate with onboarding new investors. When charged, you may expect 1-3%.

5. Due Diligence Fees

Certain funds may charge a separate fee for performing due diligence on your application, which generally ranges between €1,500 and €3,000.

6. Legal Fees

Legal fees for a Golden Visa application can vary base on several factors, including the law firm you choose and the number of family members includes in the application. For a family of four seeking a Golden Visa in Portugal, legal fees may typically range from €6,000 to €12,000.

Portugal Golden Visa Application Process

The duration of the Golden Visa process depends on various factors, such as the time you take to make a decision, how quickly you can provide the required documents. Here’s a step-by-step guide to the Portuguese Golden Visa Investment Fund process:

Portugal Golden Visa Investment Funds Required Documents

When applying for the Portuguese Golden Visa, you are required to submit various documents to the Agency for Integration, Migration, and Asylum (AIMA). The list below serves as a reference guide and is not exhaustive, as the authorities may request additional documents as needed.

Portugal Golden Visa Required Documents

To apply for the Portugal Golden Visa you must provide the following supporting documents:

- Golden Visa application

- Valid passport and, if applicable, a valid Schengen visa, for each applicant.

- Criminal record certificate

- Applicant’s permission for AIMA to access his/her Portuguese criminal record.

- Proof of residence, which can be in the form of a recent utility bill, or a recent bank statement

- Proof of having obtained health insurance valid in Portugal.

- Proof of professional occupation, such as a letter issued by the employer, should be submitted.

- Documentary evidence of the eligibility of family member applicants

- Certificate of no debts from the Portuguese tax and insurance offices

- Signed statement affirming their commitment to meet the investment requirements

- Evidence of the minimum investment

- Letter from a local bank confirming the funds’ transfer.

- Document demonstrating your ownership of the participation units in the fund.

- Declaration issues by the investment fund’s management company outlining the business plan, maturity dates (of at least five years), and the deployment of at least 60 percent of the fund portfolio towards investments in Portugal.

Golden Visa Investment Fund Required Documents

To meet the requirement for the Golden Visa investment funds, you must provide the following additional supporting documents:

- Declaration from a registered Portuguese institution confirming the successful transfer of funds that meet the minimum investment requirement.

- Document demonstrating your ownership of the participation units in the fund, free from any encumbrances or liens.

- Declaration issued by the investment fund’s management company outlining the business plan, maturity dates (of at least five years), and the deployment of at least 60 percent of the fund portfolio towards investments in Portugal.

Processing Time for Portugal Golden Visa

Here you can find a flowchart for a better understanding:

Portugal Golden Visa Renewals Requirements

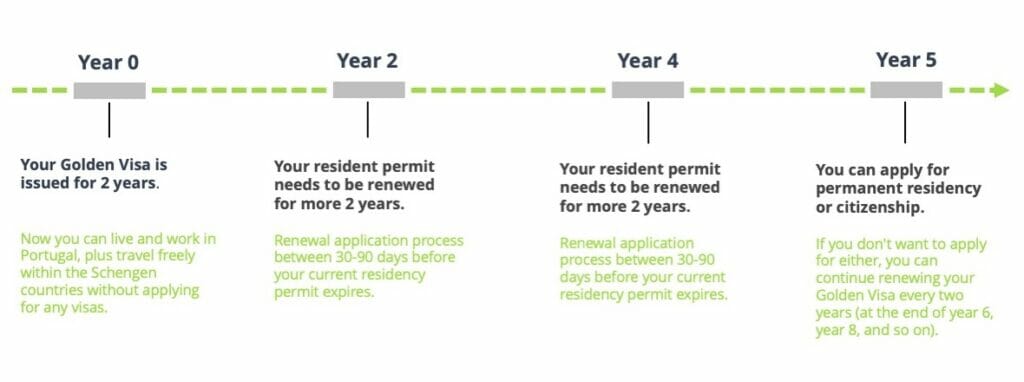

During the five-year duration of the Golden Visa program, the applicant will need to renew their visa twice. The 1st renewal is due at the end of year two, after the issuance of the residency card and the 2nd renewal is due at the end of year four.

- Investors and their family members are require to adhere to a minimum stay of 14 days in Portuguese territory within each residence card’s validity period.

- Renewals necessitate the submission of the same documents and the maintenance of all initial application conditions.

- Every two years, all investment options must undergo an evaluation regarding their contributions to scientific and cultural activities, as well as their role in promoting foreign direct investment and job creation.

- Throughout the Golden Visa period, investors are obligates to maintain their investments free from encumbrances and financial burdens.

Portugal Golden Visa Investment Fund: Key Considerations for US Clients

If you’re an American citizen considering investing in a Portugal Golden Visa fund, it’s essential to follow specific regulations.

FATCA

One of the initial steps is opening a Portuguese bank account that complies with FATCA (Foreign Account Tax Compliance Act) regulations. FATCA is a U.S. law designed to prevent tax evasion by requiring foreign financial institutions to report accounts and assets held by American citizens directly to the IRS.

Choosing a FATCA-compliant bank is crucial for ensuring your investment aligns with U.S. tax laws, reducing the risk of non-compliance with IRS requirements.

PFIC

The Passive Foreign Investment Company (PFIC) rules were established to prevent U.S. persons from deferring tax on passive income generated through non-U.S. corporations. These rules also aim to restrict the conversion of passive income into capital gains, which are typically taxed at preferential rates.

Nearly all foreign mutual funds qualify as PFICs, including Portuguese investment funds that meet the criteria for the Golden Visa program.

Examples of Passive Foreign Investment Companies (PFICs) include:

- Foreign Mutual Funds,

- Foreign Venture Capital Funds

- Foreign ETFs (Exchange-Traded Funds)

- Foreign Retirement Accounts

- Foreign REITs (Real Estate Investment Trusts)

- Foreign Insurance Products

- Foreign Holding Companies

- Foreign Brokerage Accounts

Form 8621

Form 8621, officially titled “Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund”, is a U.S. tax form used to report ownership in a Passive Foreign Investment Company (PFIC) and any income or gains associated with that ownership.

Who Needs to File Form 8621?

- Any U.S. person who owns shares in a PFIC (directly or indirectly).

- Individuals who received income, gains, or distributions from a PFIC.

- U.S. taxpayers making specific elections related to PFICs.

When Must Form 8621 Be Filed?

Form 8621 must be filed annually or whenever a U.S. person has ownership in a Passive Foreign Investment Company (PFIC) and certain events occur.

The form is generally due with your annual U.S. tax return, which is typically April 15. If you file for an extension, the deadline can be extended to October 15. For U.S. taxpayers living abroad, an automatic extension is granted until June 15, with the option to request further extensions if needed.

Glossary for the Portugal Golden Visa Investment fund

FCR (Fundo de Capital de Risco): Private Equity Fund or Venture Capital Fund, refers to funds focused on investments in startups, growing companies, or other private businesses.

UP (Unidade de Participação), or PU (Participation Unit) in English, is the equivalent of stocks or shares in an investment fund.

General Partner (GP): The General Partner is the fund management company responsible for identifying, evaluating, and managing investments. The GP invests its own capital in the fund and oversees its operations.

Exit Strategy: An exit strategy is the plan to divest from a company in which the private equity fund has invested. Common exit strategies include IPO (Initial Public Offering), selling to another company or investor, or a management buyback of the company.

CMVM: CMVM stands for “Comissão do Mercado de Valores Mobiliários,” which translates to the Portuguese Securities Market Commission. CMVM is the regulatory authority responsible for supervising and regulating the securities market in Portugal.

If you are interested in discovering a wider range of acronyms associated with Portugal Golden Visa investment funds, we invite you to read our comprehensive article available here.

Why choose Portugal Residency Advisors for your Golden Visa Investment?

Local Expertise

We know Portugal. Due to our extensive local knowledge, we believe that concentrating our services in a single country destination is the best way to give you the most thorough and useful information.

Holistic Approach

One single channel of communication for the entire process. We provide you with a comprehensive service that covers all aspects of your move, from identifying the ideal residency visa to finding your new home or helping you to settle.

Transparent Service

We recommend what’s best for you based on an extensive process experience that saves time and money to clients. Our pricing is clear and competitive, and we don’t sell services that make us more money.

Simple Process

Technology plays a very important role in our company. We minimize our clients’ involvement in paperwork. We are customers ourselves and we know how to serve you.

Frequently Asked Questions About Portugal Golden Visa Funds

What is the Golden Visa investment fund option?

The Golden Visa investment fund option allows investors to obtain Portuguese residency by making a qualifying investment in an eligible investment fund.

What is the minimum investment amount required for the Golden Visa investment funds?

The minimum investment amount is €500,000.

Can I choose any investment fund for the Golden Visa program?

No, you must select an investment fund that is pre-approved and meets the requirements specified by the Portuguese authorities for the Golden Visa program.

How long do I need to maintain the investment in the fund?

The investment must typically be maintained for a minimum period, usually five years, to retain the Golden Visa residency status.

Can I receive returns or dividends from the investment fund?

Yes, depending on the specific investment fund, you may receive returns or dividends based on the fund’s performance and investment strategy.

Can I include my family members in the Golden Visa application?

Yes, you can include your spouse or partner, dependent children, and dependent parents in your Golden Visa application.

What are the benefits of the Golden Visa investment funds?

The benefits include residency in Portugal, visa-free travel within the Schengen Area, access to Portuguese healthcare and education systems, and the opportunity for potential capital appreciation.

Can I apply for Portuguese citizenship through the Golden Visa investment funds?

Yes, after holding the Golden Visa for a certain period and meeting additional requirements, you may be eligible to apply for Portuguese citizenship.

Do I need to reside in Portugal to maintain the Golden Visa?

No, the Golden Visa allows for flexible residency requirements, and you are not required to reside in Portugal for a specific period.

Can I invest in multiples funds for the Golden Visa application?

Yes, it is generally possible to invest in more than one fund for the Golden Visa application