Do you wanna Immigrate to Portugal from Canada?

Are you a Canadian contemplating a move to Portugal? Congratulations on a remarkable choice! Portugal offers an exceptional quality of life. And a more affordable cost of living compared to Canada. Moreover, it’s considered one of the prime gateways to obtaining European citizenship.

If you don’t possess an EU passport, securing a residency visa may be your first step. Your journey commences right here, as we delve into the essential details to make your transition as smooth as possible.

Why Canadians are moving to Portugal?

Canadians, like individuals from many other countries, are choosing to move to Portugal for a variety of reasons. Some of the factors driving this decision include:

Quality of Life: Portugal consistently ranks high for its quality of life. Canadians are drawn to the country’s pleasant climate, beautiful landscapes. And a slower pace of life, especially in regions like the Algarve.

Lower Cost of Living: Portugal is often more affordable than many Canadian cities, offering expats a chance to enjoy a comfortable lifestyle without breaking the bank.

Safe Environment: Portugal is recognized as one of the safest countries in Europe, providing a secure environment for residents and their families.

Portuguese Citizenship: Portugal offers pathways to residency and even citizenship for expatriates. Also including the Golden Visa program and other immigration options.

Healthcare: Portugal provides access to quality education and healthcare systems, making it an attractive option for families and retirees.

Proximity to Other European Destinations: Portugal’s location in southwestern Europe makes it a convenient starting point for exploring other European countries and cultures.

Comparison Portugal Vs. Canada

How to move to Portugal from Canada?

Just like any international relocation, moving from Canada to Portugal entails adhering to the necessary immigration. And also procedures to ensure a smooth transition and establish your legal status in your new home.

For non-EU citizens, including Canadians, who plan to reside in Portugal for a period exceeding 90 days. And it is imperative to initiate the process by applying for a residency visa. This visa will grant you the authorization to live in Portugal for an extended duration.

After your arrival in Portugal, the next crucial step for Canadians is to visit the Agency for Integration, Migration and Asylum (AIMA), former SEF. At AIMA, you can complete the application for a residence permit, which is essential for establishing your legal residency in the country.

take a free eligibility test

Residency Visas for Canadians

Canadians who want to relocate to Portugal have access to different types of visas, depending on the purpose of their move. The specific types of visas available in Portugal for Canadians are:

Portugal D7 Visa: Immigrate to Portugal from Canada

Portugal D7 Visa, also known as the Retirement Visa or Passive Income Visa, was introduced in 2007 by the Portuguese government. Also allowing non-EU/EEA/Swiss citizens to apply for temporary residency in Portugal.

Retirees and individuals with a minimum regular minimum passive income of €870 per month can apply for the Portugal D7 Visa. This income can include pensions, real estate, royalties, dividends, financial investment, or intellectual property.

Additionally to be eligible for D7 Visa in Portugal you must have sufficient means to reside in Portugal for one year. And which is equivalent to €10,440, plus you need to add 50% of this amount for your partner and 30% for each dependent child.

This Visa is valid for a period of two years and can be renewed for additional three-year period. After 5 years you have the option to apply for a permanent residence permit or Citizenship.

Portugal Digital Nomad Visa

The D8 Visa also know as, Digital Nomad Visa Portugal, was introduced in October 2022 by the Portuguese government, allowing non-EU/EEA/Swiss citizens, with a minimum monthly income of €3,480, to apply for temporary residency in Portugal while working remotely from Portugal.

The Portugal Digital Nomad Visa has two different routes:

Temporary Stay Visa: The Temporary Stay Visa is perfect if you don’t want to apply for temporary residency, but you would like to stay in Portugal for an extended period. The Visa is valid for one year and can be extended for another two years. This temporary stay visa will grant you multiple entries into the country allowing you to travel outside Portugal. And experience other European countries.

Residence Permit: The Residency Visa is a good solution if you want to stay in Portugal for more than one year. Please note that your Temporary Resident Visa is only valid for four months and within this period you need apply for a Temporary Residency Permit. The permanent residence permit is valid for a period of two years and can be renewed for additional three-year period.

Portugal D2 Visa

D2 Visa Portugal was launched in 2018 and is a type of long-stay visa for Portugal that is specifically designed for entrepreneurs. And who want to start or buy a business in Portugal.

The visa allows non-European Union citizens to stay in Portugal for up to 4 months and after applying for the resident permit. A Portuguese Residence Permit after the D2 Visa is valid for two years. And then it can be renewed for three years contingent on the continuity of the applicant’s professional activities. After five years of legal residency, the individual may apply for Portuguese nationality.

The D2 visa is also known as the “Entrepreneur Visa” or “Business Visa” is issued to individuals who wish to invest in a Portuguese company. or start their own business in Portugal. The visa aims to support the growth of innovative and sustainable startups that can contribute to Portugal’s economy.

The main requirements for the business visa are quite soft because you can open your company in any sector. Those are from a retail shop to a coffee or a restaurant and you don’t need to get any approval form a Portuguese incubator.

Portugal Golden Visa

The Portugal Golden Visa program in Portugal, also known as the Residence Permit by Investment Program, is an investment immigration program that grants residency and citizenship rights to foreign investors who make a significant economic contribution to the country. Here you can find the most popular Golden visa investment options:

Investment Funds: Contribution of €500,000 or higher, for the acquisition of units of investment funds or venture capital fund of funds under the Portuguese legislation

Cultural Heritage Contribution: Donation of a minimum of €250,000 for investing in artistic output or supporting the arts, for reconstruction or refurbishment of the national heritage, through the local and central authorities, public institutions or, private foundations of public interest

How Canadians can I apply for a Portugal residency Visa?

The initial step in your move from Canada to Portugal is to apply for a Portuguese residence visa. To do so, you must submit the appropriate documentation to one of the Portuguese consulate offices in Canada. Here are the requirements to keep in mind when applying for a residence visa:

- Visa Application Form

- Your Valid Passport

- Two recent passport-size photos

- Criminal Record certificate

- Valid travel insurance, including medical coverage and repatriation

- Documentary evidence of having accommodation in Portugal

- Proof of sufficient means in Portugal (latest 3 months bank statements)

- Declaration with the reasons for requesting Portuguese Residency

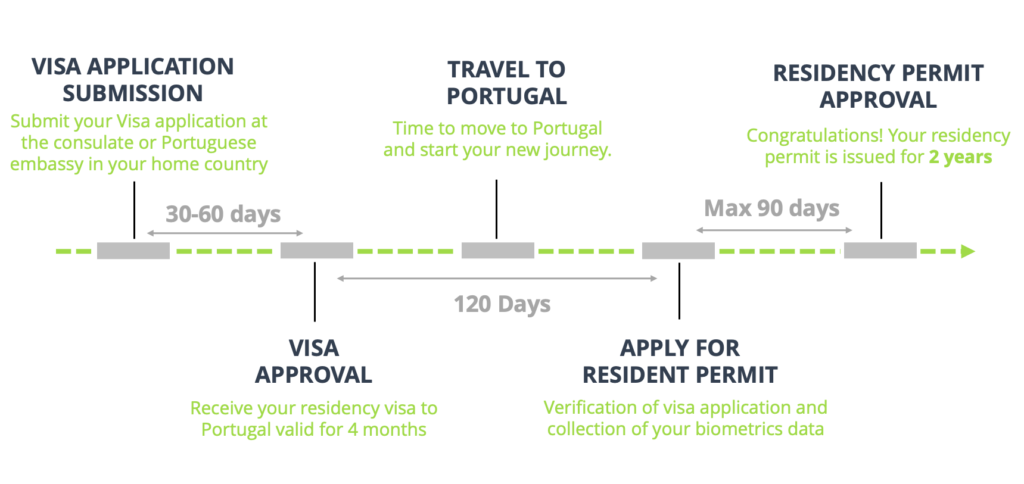

Cycle time for visa application to Portugal

Where do Canadians live in Portugal?

Canadians living in Portugal can be found in various regions across the country, each offering a unique set of advantages and lifestyle options. Some popular areas where Canadians and other expatriates often choose to reside in Portugal include:

Canadians in Lisbon

In Lisbon, the captivating capital of Portugal, the city’s rich cultural tapestry extends far beyond its native population. With a total population of 2,884,170, Lisbon thrives as a dynamic and diverse metropolis. Notably, within this bustling cityscape, a vibrant community of expatriates has found its home. Among them, 343,995 foreigners have chosen to settle in Lisbon, contributing to the city’s cosmopolitan character.

Among these international residents, Canadians stand as a notable presence in Lisbon. Drawn by the city’s historic charm, thriving job market, and welcoming atmosphere, many Canadians have found Lisbon to be an enticing destination. Whether it’s the blend of old-world charm and modernity, the Mediterranean climate, or the picturesque landscapes, Lisbon’s allure is undeniable.

Canadians in the Algarve

In the stunning region of the Algarve, nestled along Portugal’s southern coastline, Canadians have found a slice of paradise to call their own. With a total population of 469,938 residents, the Algarve boasts an enchanting blend of natural beauty, historic charm, and a vibrant way of life. Yet, what truly makes the Algarve unique is the extraordinary diversity that thrives within its borders.

Here, more than 105,000 foreign residents, including a significant number of Canadians, have chosen the Algarve as their adopted home. Their presence accounts for an impressive 22% of the region’s population. This thriving international community brings a rich tapestry of cultures, perspectives, and traditions to the Algarve, enhancing the region’s already abundant appeal.

Canadians are captivated by the allure of the Algarve. Its picturesque coastal towns, sun-drenched beaches, and laid-back Mediterranean lifestyle create an idyllic setting for those seeking a change of pace. Moreover, the warm climate, welcoming atmosphere, and abundant opportunities for cultural immersion make it an ideal destination for Canadians looking to relocate to Portugal.

Canadians in Madeira

The enchanting island of Madeira, nestled in the Atlantic Ocean, has become a beloved haven for Canadians and a growing expatriate community. With its lush landscapes, subtropical climate, and a relaxed island lifestyle, Madeira offers a unique blend of natural beauty and cultural richness that attracts residents from around the world.

While the specific number of Canadians residing in Madeira may vary over time, it’s not uncommon to find Canadians who have made the island their home. Some are drawn to the island’s natural wonders, from its dramatic cliffs and forests to its botanical gardens and vibrant flora. Others are enticed by the island’s unique cultural heritage, warm local community, and its reputation as a haven for retirees seeking a tranquil yet vibrant setting.

The Canadian presence in Madeira, though relatively small compared to other nationalities, contributes to the island’s rich tapestry, adding to its diversity and cultural exchange. As more Canadians discover the allure of this stunning Atlantic island, the expatriate community in Madeira continues to grow, making it an even more attractive destination for those seeking a unique and idyllic place to call home.

Cons of Living in Portugal

Bureaucracy

Portugal is known for its bureaucratic processes, which can be frustrating for both locals and foreigners. Obtaining residency, registering a business, and dealing with government agencies can all be time-consuming and require a lot of paperwork.

Many people find it helpful to hire a lawyer or a consultant to help them navigate the system. This can be an added expense, but it can also save time and prevent headaches in the long run.

Relaxed attitude

While the relaxed attitude in Portugal is often seen as a positive aspect of the culture, it can also have some disadvantages. One potential con of this attitude is that it can lead to a lack of punctuality in certain aspects of life.

Portuguese people tend to take a more relaxed approach to time, and this can sometimes result in appointments or meetings starting later than scheduled, which can be frustrating for individuals who value punctuality. Additionally, the relaxed attitude can sometimes lead to a lack of organization and structure in certain aspects of life.

Transport Infrastructure

While Portugal has made significant improvements to its transportation infrastructure in recent years, it still lags behind other European countries in some areas. Public transportation can be unreliable, especially outside of major cities, which make people opt to own a car, which can be expensive due to taxes and insurance.

However, Portugal’s small size means that travel times are relatively short, so even with transportation challenges, getting around the country is still manageable.

Cards Payment Acceptance

Cash is still king in Portugal, and many businesses, especially smaller ones, only accept cash payments. This can be inconvenient for those used to using cards for all transactions.Additionally, some businesses may only accept Portuguese debit or credit cards, which can be frustrating for those who have foreign cards.

House Constructions

Many houses and apartments in Portugal were built decades ago, and they may not be up to modern standards in terms of insulation, heating, or cooling. This can be a challenge during the hot summers or cold winters. Additionally, some older buildings may require more maintenance and repairs than newer ones.

Taxation in Portugal vs. Canada

Taxation in Portugal and Canada differs in terms of tax rates, types of taxes, and regulations. Here’s a general overview of taxation in both countries:

Portugal's Tax Sytem

- Personal Income Tax (IRS): Portugal uses a progressive income tax system with rates ranging from 14.5% to 48%. In some cases, a special flat rate of 10% may apply to non-habitual tax residents on foreign income.

- Corporate Tax (IRC): The corporate tax rate in Portugal is 21% for most companies. There’s a reduced 17% rate for small and medium-sized enterprises.

- Value Added Tax (VAT): Portugal applies VAT with standard rates of 23% and reduced rates of 13% and 6% on various goods and services.

- Wealth Tax: wealth tax starting from 0,7% for high-value local properties over €600,000.

- Inheritance and Gift Tax: Portugal does not have inheritance or gift tax between close family members, but stamp duty may apply to inherited real estate.

Canada's Tax System

- Personal Income Tax: Canada uses a progressive tax system with federal and provincial or territorial tax rates. Federal rates range from 15% to 33%, and provincial or territorial rates vary.

- Corporate Tax: The corporate tax rate in Canada varies by province or territory, but the federal rate is around 15%.

- Goods and Services Tax (GST)/Harmonized Sales Tax (HST): Canada applies a federal GST at a rate of 5%, and some provinces have HST at higher rates.

- Wealth Tax: Canada does not have a wealth tax.

- Inheritance and Gift Tax: Canada does not have inheritance tax, but there may be capital gains tax on inherited assets.

Double Taxation Agreement between Portugal and Canada

The Double Taxation Agreement (DTA) between Portugal and Canada, signed on June 14, 1999, and effective on December 29, 2000, governs taxes on income and capital imposed by both countries.

Key aspects of the DTA include:

- Taxing Rights: Income earned by a resident of a Contracting State is generally taxable only in that State. Income earned by a non-resident is taxable in the other State only if it arises from a permanent establishment or fixed base there.

- Investment Income: Dividends, interest, royalties, and other investment income are generally taxable in the recipient’s country of residence. However, the DTA may limit withholding taxes imposed by the source country.

- Double Taxation Relief: The DTA provides for relief from double taxation through the foreign tax credit method, allowing residents to credit foreign taxes paid against their home country tax liability. In some cases, income may also be exempt from tax in the source country.

Let's create your plan

Cost of living in Portugal vs Canada

Comparing the cost of living in Portugal and Canada, using Numbeo data, reveals intriguing insights, particularly when considering consumer prices, including rent. In the specific case of Lisbon, the capital city of Portugal, consumer prices are approximately 30.5% higher than in Ottawa, the capital of Canada. This data highlights the significant contrast in living costs between these two cities.

Lisbon’s status as the most expensive city in Portugal implies that relocating to other regions within the country could result in an even more beneficial impact on the cost of living. Portugal, overall, is renowned for providing an affordable lifestyle, and its smaller cities and towns often offer a more cost-effective alternative, which is especially enticing to expatriates.

Furthermore, when compared to neighboring countries such as Spain or France, Portugal maintains its reputation as an exceptionally compelling choice for those in pursuit of a high quality of life at a reasonable cost.

Is Portugal a safe country?

Portugal’s reputation as one of the safest countries in the world is well-deserved and has not gone unnoticed. The Global Peace Index from 2023, a respected measure of safety and peace, places Portugal at a commendable seventh position.

What sets Portugal apart is its consistent dedication to maintaining social stability and safety for all. A low crime rate, a well-functioning legal system, and effective law enforcement agencies are crucial elements in this endeavor. According to Numbeo’s 2024 Crime Index by Country, Portugal boasts a strong safety rating of 68.8 percent, compared to other European nations.

The result is a welcoming atmosphere that embraces diversity and fosters a sense of security, making it an appealing choice for people from around the world. In case you are a female solo traveller you should know that a recent report by TimeOut places Portugal at the top of the list of the safest countries for solo female travelers.

Comparing Portugal’s ranking with Canada, which is itself renowned for safety, further underscores the country’s commitment to maintaining a peaceful society. Canada’s position at #11 on the Global Peace Index highlights the high standard of safety in both countries, making them ideal choices for residents seeking tranquility and a secure environment.

Portugal's healthcare system for expats

Portugal’s healthcare system is renowned for its dedication to providing accessible and high-quality medical services. The foundation of this system is the national health service, known as Serviço Nacional de Saúde (SNS), which serves as the cornerstone of healthcare provision in the country.

SNS offers a range of healthcare services, from routine check-ups to specialized treatments, with a focus on ensuring that all Portuguese citizens have access to medical care when they need it.

What makes Portugal’s healthcare system truly remarkable is its inclusivity. SNS extends its services not only to Portuguese citizens but also to residents with a valid residence permit and those covered by reciprocal healthcare agreements. This means that expatriates and foreigners living in Portugal, who meet the necessary criteria, can benefit from the same level of care as the local population.

According to Numbeo’s 2024 Healthcare Index by Country, Portugal’s healthcare system ranks 21st globally.

Portugal’s healthcare professionals are highly skilled, and many are fluent in English, making it easier for expatriates to communicate their healthcare needs. The country also boasts a network of state-of-the-art medical facilities, hospitals, clinics, and pharmacies, ensuring that a wide range of medical services are available across the nation.

Flights from Canada to Portugal

Flights from Canada to Portugal are available from various major Canadian cities to multiple airports in Portugal, with Lisbon and Porto being the primary destinations. Here are some of the key details:

Departure Cities in Canada:

- Toronto Pearson International Airport (YYZ) in Toronto, Ontario

- Montréal-Pierre Elliott Trudeau International Airport (YUL) in Montréal, Quebec

- Vancouver International Airport (YVR) in Vancouver, British Columbia

- Calgary International Airport (YYC) in Calgary, Alberta

- Ottawa Macdonald-Cartier International Airport (YOW) in Ottawa, Ontario

- Edmonton International Airport (YEG) in Edmonton, Alberta

Airlines: Several international airlines offer direct or connecting flights between Canada and Portugal. Some popular airlines include Air Canada, TAP Air Portugal, Air Transat, Lufthansa, British Airways, and others.

Arrival Cities in Portugal:

- Lisbon Portela Airport (LIS) in Lisbon

- Francisco Sá Carneiro Airport (OPO) in Porto

- Faro Airport (FAO) in Faro (Algarve region)

Flight Duration: The flight duration from Canada to Portugal can vary depending on the departure city and whether it’s a direct or connecting flight. Direct flights typically take around 7 to 8 hours, while connecting flights may take longer, depending on the layover location and duration.

Is buying a property in Portugal a good investment?

Buying a house in Portugal can be a good investment for several reasons, but it depends on various factors and your individual circumstances. Here are some advantages you may consider:

- One of the most secure and appealing real estate markets in Europe

- Lowest real estate prices compared to other European capital cities

- High rental income yields can be found, especially in city centers and tourist areas due to the shortage of housing

- Investors are strongly protected by Portuguese legislation compared to other markets

- There are a diversified range of buying and investment opportunities in the capital, coast, or countryside

Buying property in Portugal as a foreigner

Foreigners, including Canadians, have the opportunity to purchase property in Portugal, and the process, for the most part, is straightforward. Here are key considerations to bear in mind when looking to buy property in Portugal as a foreigner, including Canadian citizens:

Portuguese Tax Identification Number (NIF): Before you can engage in property transactions, you’ll need to acquire a Portuguese tax identification number (NIF). This essential document can be obtained from the Portuguese tax office (Finanças) and is a prerequisite for property acquisition.

Portuguese Bank Account: To complete the property purchase process, having a Portuguese bank account is imperative. This account serves as the hub for financial transactions related to the property acquisition, including the transfer of funds, tax payments, fees, and receipt of rental income.

Legal Representation: It is highly advisable to collaborate with a proficient Portuguese lawyer, preferably one experienced in real estate transactions. This legal expert can assist you in navigating the intricacies of the property purchase, ensuring that all aspects are compliant with the law.

Home Insurance: Property insurance, also known as home insurance, is a mandatory requirement in Portugal. It provides coverage for various contingencies, such as damage to your property and personal belongings, as well as liability protection in case of injuries occurring on your premises.

Why work with Portugal Residency Advisors?

Local Expertise

We know Portugal. Due to our extensive local knowledge, we believe that concentrating our services in a single country destination is the best way to give you the most thorough and useful information.

Holistic Approach

One single channel of communication for the entire process. We provide you with a comprehensive service that covers all aspects of your move, from identifying the ideal residency visa to finding your new home or helping you to settle.

Transparent Service

We recommend what’s best for you based on an extensive process experience that saves time and money to clients. Our pricing is clear and competitive, and we don’t sell services that make us more money.

Simple Process

Technology plays a very important role in our company. We minimize our clients’ involvement in paperwork. We are customers ourselves and we know how to serve you.

Frequently Asked Questions About Immigrate to Portugal From Canada

Do Canadians need a visa to enter Portugal?

Canadian citizens can enter Portugal for short visits (up to 90 days) without a visa. For longer stays or if you plan to work or study in Portugal, you will need a visa or residence permit.

What are the different types of residence permits for Portugal?

There are several types of residence permits in Portugal, including work permits, study permits, family reunification permits, and retirement visas. The specific permit you’ll need depends on your circumstances.

How can I apply for a residence permit in Portugal from Canada?

You can apply for a residence permit by contacting the Portuguese consulate or embassy in Canada. Each type of residence permit has its specific requirements and application process.

What is the Golden Visa program in Portugal?

The Golden Visa program is a residency by investment option for investors looking to obtain residency in Portugal. By investing a minimum of €500,000 in investment funds or €200,000 in a cultural production in a low density area, you can obtain a residence permit.

How can I find a job in Portugal as a Canadian immigrant?

You can search for job opportunities in Portugal online or through job search websites. Additionally, networking and working with recruitment agencies can be helpful in finding employment.

Is there a language requirement for immigration to Portugal?

No. You don’t need to speak Portuguese for applying for a immigration visa to Portugal. However proficiency in Portuguese can be beneficial when dealing with local community.

What is the cost of living in Portugal compared to Canada?

The cost of living in Portugal is on average 30% lower than in Canada but it varies depending on your location and lifestyle. Major cities like Lisbon and Porto tend to be more expensive than rural areas.

Is healthcare in Portugal accessible for immigrants from Canada?

Portugal has a good healthcare system. If you’re a legal resident, you can access healthcare through the National Health Service (SNS) or choose private healthcare.

Can I bring my family to Portugal with me?

Yes, you can typically bring your family members with you to Portugal. Family reunification permits are available for this purpose.

What are the tax implications of moving from Canada to Portugal?

If you plan to spend more than 183 days in Portugal, then you become a tax resident in Portugal. However Portugal offers a Non-Habitual Resident (NHR) tax regime that can be beneficial for expatriates.